Potential Investment Opportunities: Analyzing Current and Future Prices of Lithium Ore in Nigeria

Potential Investment Opportunities: Analyzing Current and Future Prices of Lithium Ore in Nigeria

Are you an investor searching for the next big opportunity? Look no further! In today’s blog post, we will dive deep into the world of lithium ore in Nigeria, analyzing both current and future prices. As the demand for lithium continues to skyrocket due to its crucial role in electric vehicles and renewable energy storage, understanding the potential investment opportunities could be a game-changer. Join us as we uncover valuable insights that may set you on a path towards financial success in this booming industry.

Understanding the Importance of Lithium Ore

Understanding the Importance of Lithium Ore:

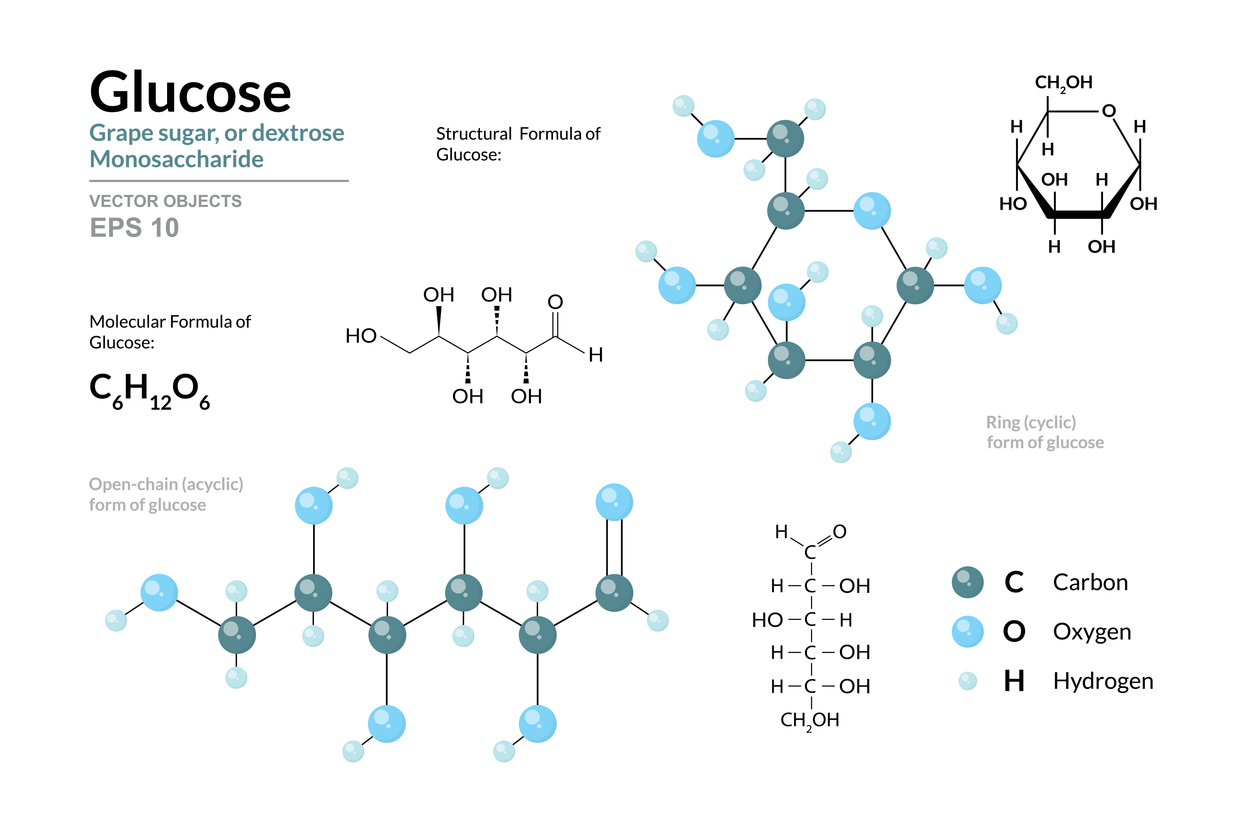

Lithium ore, also known as lithium carbonate, is a highly valuable mineral that has gained significant attention in recent years due to its importance in the production of batteries for electric vehicles and renewable energy storage systems. It is also used in various other industrial applications such as ceramics, glass manufacturing, and pharmaceuticals. In this section, we will delve into the key factors that make lithium ore an essential commodity and why it is considered a potential investment opportunity.

1. Growing Demand for Electric Vehicles:

One of the primary drivers of the increasing demand for lithium ore is the rapid growth in the electric vehicle (EV) market. As countries around the world strive to reduce their carbon footprint and shift towards sustainable transportation options, there has been a significant rise in sales of EVs. According to BloombergNEF’s Electric Vehicle Outlook report, global EV sales are expected to reach 54 million by 2040, which would account for over half of all new car sales. This surge in EV demand directly translates into higher demand for lithium-ion batteries, making lithium ore a crucial component in this supply chain.

2. Renewable Energy Storage:

Lithium-ion batteries are also widely used in renewable energy storage systems such as solar panels and wind turbines. With the increasing adoption of renewable energy sources to combat climate change and reduce reliance on fossil fuels, there has been a surge in demand for these storage systems. The International Renewable Energy Agency (IRENA) forecasts that global renewable energy capacity

Current State of the Lithium Market in Nigeria

The lithium market in Nigeria has seen significant growth and potential in recent years. As the demand for lithium, a key component in the production of batteries for electric vehicles and renewable energy storage, continues to rise globally, Nigeria is emerging as an important player in the industry.

Currently, Nigeria is ranked as one of the top five countries in Africa with large reserves of lithium ore. According to data from the United States Geological Survey (USGS), Nigeria’s estimated lithium reserves stand at 15,000 metric tons. This is a significant increase from previous estimates which were only at 9,000 metric tons.

One factor that has contributed to this increase in reserves is the discovery of new deposits of spodumene-bearing pegmatites in different parts of the country such as Nasarawa, Ekiti, and Kogi states. These discoveries have attracted both local and foreign investors who are keen on tapping into Nigeria’s vast potential for producing high-quality lithium ore.

In terms of production, Nigeria currently produces small quantities of lithium ore compared to other major producers such as Australia and Chile. However, with increased investments and government support towards developing its mining sector, there is great potential for growth in production levels.

The current state of the lithium market in Nigeria can be described as promising but still relatively untapped. The majority of mining activities are still at an early stage with limited commercial extraction taking place.

Factors Affecting the Price of Lithium Ore in Nigeria

There are several key factors that influence the price of lithium ore in Nigeria, both in the current market and for future projections. These factors can range from global demand for lithium to local mining regulations and political stability. As a potential investor, it is crucial to understand these factors and their impact on the price of lithium ore in Nigeria before making any investment decisions.

1. Global Demand:

One of the main drivers of the price of lithium ore is its global demand. In recent years, there has been a significant increase in demand for lithium due to its use in batteries for electric vehicles, consumer electronics, and renewable energy storage systems. With more countries aiming to reduce their carbon footprint and shift towards sustainable energy sources, the demand for lithium is only expected to continue rising. This global demand plays a crucial role in determining the price of lithium ore in Nigeria as it influences both supply and demand dynamics.

2. Supply Constraints:

The supply of lithium ore also has a direct impact on its price. In recent years, there has been an increased interest in exploring new sources of high-grade lithium deposits globally, which has resulted in tighter competition among countries producing this mineral. Additionally, fluctuations in production from major producers such as Chile, Australia, and China can significantly affect the availability of lithium on the market. Any disruptions or limitations in supply can lead to an increase in prices.

– Demand and Supply

Demand and supply are two crucial factors that determine the prices of commodities in any market, including the lithium ore market in Nigeria. In this section, we will delve into the current and future trends of demand and supply for lithium ore in Nigeria, to provide a comprehensive understanding of the potential investment opportunities.

Demand:

The global demand for lithium has been steadily increasing in recent years due to its vital role in the production of lithium-ion batteries used in various electronic devices, such as smartphones, laptops, and electric vehicles. This trend is expected to continue as more countries aim to shift towards clean energy sources and reduce their carbon footprint.

In Nigeria, there is also a growing demand for lithium ore due to its potential use in renewable energy projects. The government’s push towards diversifying its economy away from oil dependence has led to increased investments in renewable energy sources like solar power plants. These projects require large quantities of lithium-ion batteries, thus driving up the demand for lithium ore.

Moreover, with the rise of electric vehicles globally, many automotive manufacturers are looking to establish manufacturing plants in Nigeria. This would further boost the demand for lithium ore as it is a key component in electric vehicle batteries.

Supply:

Nigeria is richly endowed with vast reserves of mineral resources, including substantial deposits of lithium ore. However, despite having significant reserves estimated at 21 million tonnes (MT), most of these resources remain untapped due to limited exploration and mining activities.

– Government Policies and Regulations

The Nigerian government has recognized the potential of lithium ore as a valuable resource and has implemented policies and regulations to attract investment in this sector. In this section, we will delve into the various government policies and regulations that impact the current and future prices of lithium ore in Nigeria.

1. National Mineral Policy:

The National Mineral Policy of Nigeria, formulated in 2008, aims to develop the country’s mineral resources for sustainable economic growth. This policy recognizes lithium as a strategic mineral with high potential for use in emerging industries such as electric vehicles and renewable energy storage systems. The policy provides a conducive environment for investment by streamlining procedures for obtaining exploration licenses and mining leases.

2. Mining Act of 2007:

The Mining Act of 2007 governs all mining activities in Nigeria, including those related to lithium ore. This act allows for private ownership of mineral resources and grants miners exclusive rights to explore, mine, and sell minerals within their mining lease areas. It also outlines environmental protection measures that must be adhered to during mining operations.

3. Tax Incentives:

To attract foreign investment in the lithium sector, the Nigerian government offers tax incentives such as five years tax holiday for new mining companies, duty-free importation of machinery and equipment used in mining activities, and exemption from customs duties on raw materials used for processing minerals.

4. Local Content Policy:

In line with its local content development strategy, the Nigerian government requires investors in the mining sector to source goods and services locally whenever possible.

– Technological Advancements

Technological advancements have played a significant role in the growth of the lithium ore market in recent years. With increasing demand for lithium-ion batteries, which are used in various electronic devices and electric vehicles, there has been a constant need for technological innovations to improve the efficiency and production of lithium ore.

One of the major technological advancements that have impacted the lithium market is the development of new extraction methods. Traditionally, lithium was primarily extracted from hard rock mines through a process known as spodumene mining. However, with advancements in technology, new methods such as brine extraction and clay-based extraction have gained popularity.

Brine extraction involves pumping underground brine into large evaporation ponds where it is left to evaporate under the sun. This method is more cost-effective compared to traditional mining methods as it requires less energy and equipment. In Nigeria, brine deposits containing high concentrations of lithium have been discovered in some states like Kogi and Ekiti, making this an attractive investment opportunity.

Another technological advancement that has revolutionized the lithium industry is battery recycling. With increasing concerns about sustainability and environmental impact, companies are investing in technologies to recycle old or damaged batteries to recover valuable minerals like lithium. This not only reduces waste but also decreases reliance on newly mined resources.

Furthermore, developments in battery technology have led to improved efficiency and increased demand for lithium-ion batteries. The introduction of solid-state batteries has garnered significant interest due to their higher energy density and improved safety features compared to traditional liquid electrolyte batteries.

– Global Market Trends

The global market for lithium ore has been experiencing significant growth in recent years, driven by the increasing demand for lithium-ion batteries used in various industries such as electronics, electric vehicles, and renewable energy storage. This trend is expected to continue in the coming years, making lithium ore a potentially lucrative investment opportunity.

According to a report by Allied Market Research, the global lithium market size was valued at $4.93 billion in 2018 and is projected to reach $81.32 billion by 2026, growing at a CAGR of 26.7% from 2019 to 2026. This rapid growth can be attributed to several factors, including the shift towards clean energy sources and the rising adoption of electric vehicles.

One of the key drivers of this growth is the increasing demand for lithium-ion batteries in the electronics industry. The rising use of smartphones, laptops, and other electronic devices has led to a surge in demand for rechargeable batteries, which are primarily made using lithium ions. With technological advancements leading to smaller and more efficient devices with longer battery life, the demand for these batteries is expected to continue its upward trajectory.

Another major factor driving the global market for lithium is the growing popularity of electric vehicles (EVs). As countries around the world aim to reduce their carbon emissions and promote sustainable modes of transportation, there has been a significant increase in EV sales.

Analysis of Current Prices of Lithium Ore in Nigeria

Introduction:

Lithium ore, also known as spodumene, is a highly sought-after mineral used in the production of rechargeable batteries for electronic devices such as laptops, smartphones, and electric cars. With the global demand for clean energy solutions increasing, the demand for lithium ore has also seen a significant rise. Nigeria is one of the countries with potential reserves of this valuable mineral. In this section, we will analyze the current prices of lithium ore in Nigeria and discuss its potential as an investment opportunity.

Current Prices:

The current price of lithium ore in Nigeria varies depending on various factors such as quality, quantity, market demand and supply. As per recent reports by geological surveys conducted in the country, it is estimated that there are over 44 million tons of spodumene deposits found mainly in Ekiti and Kogi states. This makes Nigeria one of the largest reserves of lithium ore in Africa.

The prices for lithium ore can range from $500 to $2000 per tonne depending on its purity level and size. However, these prices are yet to be fully realized due to limited mining activities currently being carried out in the country. The lack of adequate infrastructure and technological capabilities has hindered large-scale extraction and processing operations.

Factors Affecting Prices:

The price fluctuations in lithium ore can be attributed to various factors such as global demand and supply dynamics, changes in government policies, advancements in technology for extracting and refining processes, and competition from other battery materials.

Future Projections for Lithium Ore Prices in Nigeria

The future of lithium ore prices in Nigeria is largely dependent on the global demand for this rare mineral and the country’s domestic production capabilities. With the rise of renewable energy sources and electric vehicles, the demand for lithium has been steadily increasing worldwide. This trend is expected to continue in the coming years, making it a promising investment opportunity in Nigeria.

According to industry experts, there are several factors that will influence the future projections for lithium ore prices in Nigeria. Let’s take a closer look at some of these factors and how they could impact potential investors.

1. Growing Demand

As mentioned earlier, the demand for lithium is expected to grow significantly in the next decade due to its use in various industries such as electronics, batteries, and energy storage systems. This presents an excellent opportunity for investors as Nigeria has large reserves of untapped lithium deposits, estimated at around 31 million tonnes.

Moreover, with major economies around the world shifting towards cleaner and greener energy sources, there will be a continuous need for lithium-based batteries. This will further drive up the demand for lithium ore and subsequently its prices.

2. Government Policies

The Nigerian government has recognized the potential of its vast lithium reserves and has taken steps to encourage investments in this sector. In 2019, it announced plans to establish a state-owned mining company that would focus on developing strategic minerals such as Lithium.

– Predictions by Industry Experts

Predictions by industry experts play a crucial role in identifying potential investment opportunities in the lithium ore market. These predictions are based on various factors such as current market trends, demand and supply dynamics, government policies, and technological advancements.

One of the key players in the lithium ore market is China, which accounts for more than half of global production. According to industry experts, China’s increasing focus on electric vehicles and renewable energy sources is expected to drive the demand for lithium ore in the country. This could lead to a rise in prices globally, making it an attractive investment opportunity.

In addition, with growing concerns about climate change and efforts towards reducing carbon emissions, there has been a significant shift towards clean energy sources. Lithium-ion batteries are a crucial component of this shift as they power electric vehicles and store renewable energy generated from wind or solar sources. As a result, there is an increasing demand for lithium ore globally.

Experts also predict that Nigeria’s potential entry into the global lithium market could have a significant impact on prices. Currently, Nigeria produces small quantities of lithium ore mainly for export purposes. However, with recent discoveries of large reserves of lithium deposits in the country’s central region, there is potential for Nigeria to become a major player in the global market.

Furthermore, industry experts believe that advancements in technology will continue to drive down costs associated with extracting and processing lithium ore. This could ultimately lead to lower prices and make investments in mining operations more profitable.

– Potential Investment Opportunities

Potential Investment Opportunities:

As the demand for electric vehicles and renewable energy sources continues to grow, so does the demand for lithium ore. Nigeria, with its vast untapped reserves of this valuable resource, presents a promising investment opportunity for those looking to capitalize on the global shift towards clean energy.

In this section, we will dive into the potential investment opportunities in the Nigerian lithium ore market by analyzing current and future prices of this mineral.

Current Prices:

Currently, lithium ore is not yet being actively mined in Nigeria, and as a result, there is no established market price. However, studies have shown that Nigeria has one of the largest untapped reserves of lithium in Africa, second only to Congo. This makes it an attractive destination for investors looking to enter the market at an early stage.

Additionally, there has been a recent surge in the demand for electric vehicles globally. As countries such as China and European nations set ambitious targets for switching to electric vehicles, the need for lithium batteries is expected to rise significantly. This could potentially drive up the prices of lithium ore worldwide and make investing in Nigerian reserves even more lucrative.

Future Prices:

With technological advancements and increasing awareness about sustainable living practices, it is safe to assume that clean energy solutions will continue to see a rise in demand in the coming years. In fact, experts predict that by 2030, electric cars would comprise almost 30% of total car sales globally.

Comments are closed.