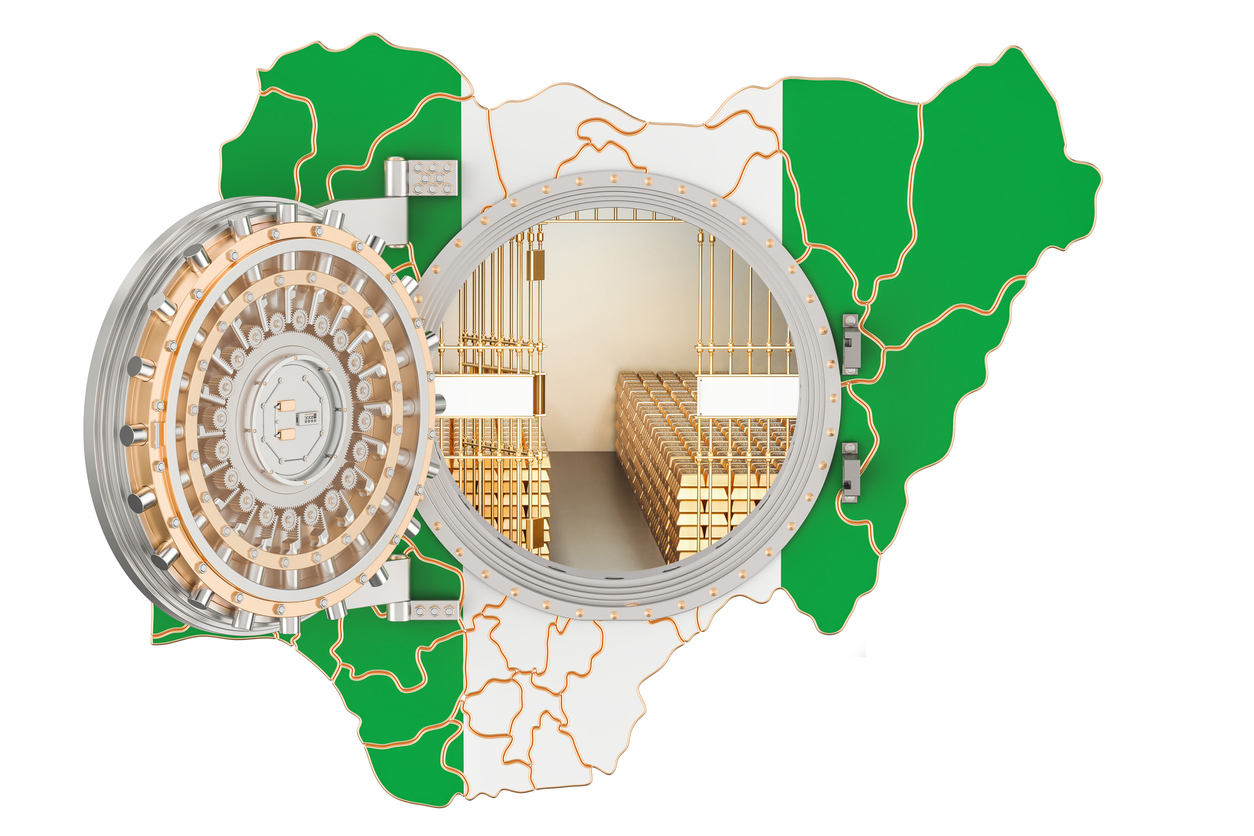

An Analysis of Nigeria’s Gold Reserves and Its Impact on The Economy

- USD|NGN

585.0 %0.0Dollar to Naira Today - GBP|NGN

798.0%0.0Pounds to Naira Today - EUR|NGN

682.0%0.0Euro to Naira Today - GHS|NGN

90.0%0.0Cedis to Naira Today - ZAR|NGN

27.0%0.0Rand to Naira Today - KES|NGN

3.85%0.0Kenyan Shilling to Naira Today - USD|GHS

₵5.74%0.0Dollar to Cedis Today

Nigeria’s Growing Gold Reserves: What It Means for Young Nigerians

Nigeria, known primarily for its vast oil reserves, is making headlines with its significant gold reserves. Recent reports highlight that Nigeria holds approximately 21.37 metric tons of gold, valued at around $1 billion. This development marks a strategic shift in Nigeria’s economic landscape, with profound implications for the future, especially for young Nigerians. Here’s what this means for you and why it’s crucial.

A New Chapter in Nigeria’s Economic Story

Traditionally, Nigeria’s economy has heavily relied on oil exports. However, the volatility of oil prices and the global push for renewable energy sources have prompted the need for economic diversification. The discovery and strategic increase of gold reserves are part of this diversification effort. By bolstering its gold reserves, Nigeria aims to stabilize its foreign exchange reserves and reduce its dependence on oil, paving the way for a more resilient economy.

Why Gold Matters

Gold is a precious metal with intrinsic value that serves as a hedge against inflation and economic instability. For Nigeria, increasing gold reserves means having a stable and reliable asset to support the economy during tough times. This move is not just about wealth accumulation but about creating a safety net that can help cushion the economy against global financial shocks.

Opportunities for Young Nigerians

- Job Creation: The expansion of the gold mining sector is expected to create numerous job opportunities. From mining and refining to logistics and sales, various roles will emerge, providing employment for young Nigerians across different educational backgrounds.

- Entrepreneurial Ventures: With more focus on gold, there are opportunities for young entrepreneurs to engage in the value chain. This includes areas such as mining equipment supply, transportation, and gold trading. By tapping into these areas, young Nigerians can create businesses that contribute to the economy.

- Educational and Skill Development: As the gold industry grows, so will the demand for skilled professionals. This will likely lead to the development of educational programs and vocational training aimed at equipping young Nigerians with the necessary skills to thrive in the mining sector.

- Economic Stability: A more diversified economy means greater stability. For young Nigerians, this translates to a more secure future with fewer economic disruptions. Stable economies tend to attract more foreign investment, leading to overall economic growth and more opportunities.

The Bigger Picture

Increasing gold reserves is more than just an economic strategy; it’s about building a sustainable future. By leveraging its natural resources wisely, Nigeria can ensure long-term economic stability and growth. This shift also means that future generations, including today’s youth, will inherit a more resilient economy capable of withstanding global market fluctuations.

Conclusion

For young Nigerians, the increase in gold reserves is a promising development. It signifies potential job opportunities, entrepreneurial ventures, and a more stable economic environment. As Nigeria continues to diversify its economy, it’s essential for the youth to stay informed and prepared to seize the emerging opportunities.

By understanding the implications of this strategic move, young Nigerians can better position themselves to contribute to and benefit from the nation’s growing economy. So, stay informed, seek out educational and professional opportunities in the gold sector, and be ready to play a part in Nigeria’s bright future.

For more detailed information and to explore business opportunities, visit Wigmore Trading.

LEAVE A COMMENT

You must be logged in to post a comment.