Anti-Dumping Duty Analysis Explained: Avoid Costly Trade Mistakes

In today’s interconnected global economy, maintaining fair competition is essential for sustainable trade growth. One of the most effective tools used by governments to counter unfair pricing practices in international trade is the anti-dumping duty. This article provides an in-depth anti-dumping duty analysis, explaining its impact on importers, exporters, and how companies like Wigmore Trading can help businesses navigate these trade complexities.

Understanding Anti-Dumping Duties

An anti-dumping duty is a tariff imposed on imported goods that are priced lower than their normal value, typically below production cost or domestic market price. The aim is to protect domestic industries from unfair foreign competition.

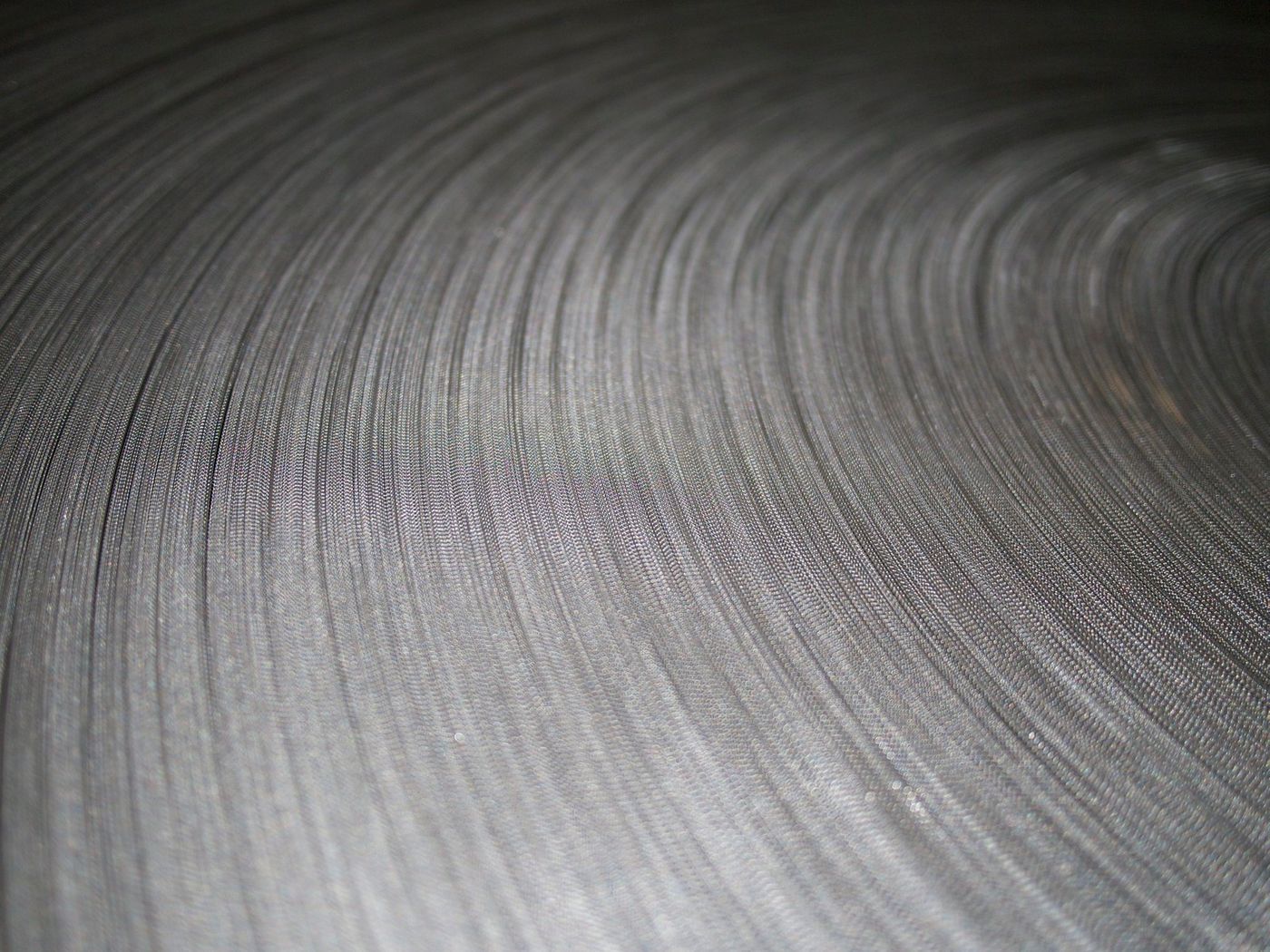

For example, if a manufacturer in one country sells steel at $500 per ton locally but exports it to another market for $350, authorities may impose an anti-dumping duty to balance the playing field.

This ensures that local producers are not driven out of the market by artificially low prices — a key aspect of maintaining fair trade across borders.

The Importance of Anti-Dumping Duty Analysis for Importers and Exporters

An anti-dumping duty analysis helps importers and exporters assess the potential risks and costs associated with international trade. Understanding whether a product is subject to such duties can influence purchasing decisions, profit margins, and supply chain planning.

For importers, a lack of due diligence can result in unexpected costs, delayed shipments, or even legal penalties. Exporters, on the other hand, may face barriers when their goods are under investigation for dumping practices.

Conducting a comprehensive anti-dumping duty analysis enables businesses to stay compliant and competitive.

Key Factors Considered in Anti-Dumping Duty Investigations

Authorities typically consider the following when conducting an anti-dumping duty analysis:

-

Normal Value – The domestic price of the product in the exporter’s country.

-

Export Price – The price at which the product is sold to the importing country.

-

Margin of Dumping – The difference between the normal value and the export price.

-

Injury Assessment – Whether domestic producers in the importing country have suffered material injury.

The process is data-driven and requires accurate financial and trade documentation. Businesses must maintain transparent records to avoid misinterpretation during investigations.

Impact of Anti-Dumping Duties on Global Trade

While anti-dumping measures aim to protect domestic industries, they can also increase import costs and limit market access for foreign producers. In regions like Africa, where countries are strengthening their trade policies, understanding these duties is vital for importers sourcing goods from Asia, Europe, or the Middle East.

For instance, African importers bringing in FMCG goods, chemicals, or steel products may face additional costs if anti-dumping duties are applied. A detailed anti-dumping duty analysis helps identify such risks early, allowing for better pricing and sourcing strategies.

Steps Businesses Can Take to Avoid Anti-Dumping Penalties

To minimize risks, companies should:

-

Conduct regular anti-dumping duty analysis before importing new products.

-

Work with experienced trade consultants or distributors like Wigmore Trading.

-

Monitor changes in trade regulations and tariffs.

-

Maintain transparent pricing and supply chain documentation.

By taking these steps, businesses can protect themselves from costly investigations and ensure smooth international transactions.

How Wigmore Trading Supports Businesses with Duty Compliance

As a leading import and export company in Africa, Wigmore Trading assists businesses in navigating trade compliance and international sourcing regulations. Through its deep understanding of African markets and global supply chains, Wigmore ensures that clients remain compliant with customs and trade laws while maintaining cost efficiency.

Whether you’re sourcing wholesale goods, industrial materials, or FMCG products, Wigmore Trading can help you assess trade barriers, manage documentation, and ensure that your imports comply with anti-dumping duty requirements.

Contact Wigmore Trading today to streamline your global sourcing and stay compliant with international trade laws.

Conclusion

An effective anti-dumping duty analysis is more than a compliance exercise — it’s a strategic tool for managing trade risks and ensuring profitability in global markets.

As governments intensify trade regulations, working with an experienced partner like Wigmore Trading helps you stay informed, compliant, and competitive.

Get in touch with Wigmore Trading today to simplify your sourcing and safeguard your business from unexpected trade duties.

Comments are closed.