How Much Does It Cost to Register a Company in Nigeria?

Check Company Name Availability

Enter your desired company name and email to check availability:

Registering a company in Nigeria involves several steps and associated costs, which vary depending on the type and size of the company. Here’s a breakdown of the costs and procedures based on current information:

1. Types of Companies

In Nigeria, the primary types of companies you can register include:

- Private Limited Company (Ltd)

- Public Limited Company (PLC)

- Company Limited by Guarantee

- Unlimited Company

- Incorporated Trustees (Non-Profit Organizations)

2. Cost Breakdown

Private Limited Company (Ltd): This is the most common type of company registration in Nigeria. The costs are categorized based on the share capital.

Share Capital:

- N1 million or less: The total cost including all fees and charges typically ranges from N15,000 to N20,000.

- Above N1 million to N500 million: Costs increase progressively with the share capital. The Corporate Affairs Commission (CAC) charges N5,000 for every additional N1 million share capital.

- Above N500 million: Registration costs are negotiable and subject to specific terms set by the CAC.

Other Costs:

- Name Reservation: N500

- Filing Fees for Registration: Varies based on the share capital

- Stamp Duty: Varies, calculated as a percentage of the share capital

- Professional Fees: If using a lawyer or consultant, additional fees may apply (typically between N50,000 to N150,000 depending on the complexity).

3. Public Limited Company (PLC)

Share Capital:

- Similar to Private Limited Companies, but initial capital requirements and filing fees are generally higher.

- Minimum Share Capital: N2 million

- Filing Fees: Higher than for private limited companies, starting from about N50,000.

4. Company Limited by Guarantee

Costs:

- Initial Filing Fee: Approximately N30,000 to N50,000

- Stamp Duty: Calculated on the share capital, similar to other company types

5. Unlimited Company and Incorporated Trustees

Unlimited Company:

- Costs: Similar to those of private limited companies, depending on the share capital.

Incorporated Trustees (Non-Profit Organizations):

- Registration Fee: Approximately N20,000

- Stamp Duty: Around N10,000 to N15,000

- Professional Fees: If applicable, typically ranges between N50,000 to N100,000.

6. Other Considerations

Post-Incorporation Costs:

- Annual Returns: Companies must file annual returns, with fees ranging from N2,000 to N5,000 for small companies and higher for larger entities.

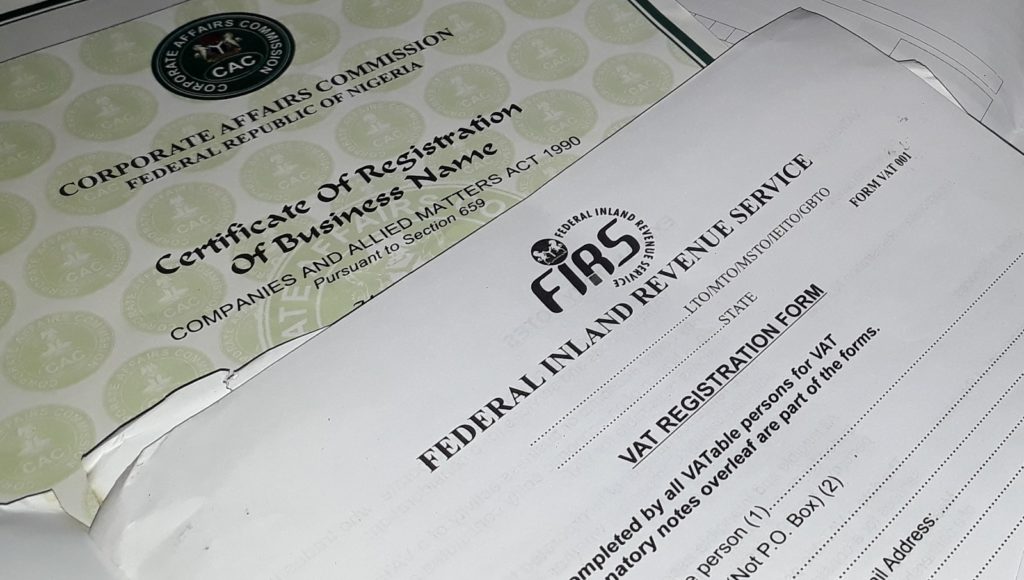

- Business Name Registration: If opting for a simpler business name registration (not a full company), costs are lower, around N10,000 to N20,000.

Summary

The cost of registering a company in Nigeria varies significantly based on the type and size of the company. For a standard private limited company with a share capital of N1 million or less, expect to spend approximately N15,000 to N20,000. Larger companies or public limited companies will incur higher fees, proportionate to their share capital.

For more detailed information and up-to-date fees, you can visit the Corporate Affairs Commission (CAC) website: Corporate Affairs Commission.

Sources

These sources provide comprehensive details on the process and costs associated with registering a company in Nigeria.

LEAVE A COMMENT

You must be logged in to post a comment.