How To Get Tax Identification Number In Nigeria

TIN Registration Checklist for Nigeria

Use this checklist to prepare for TIN registration and ensure you have everything you need!

How to Get a Tax Identification Number (TIN) in Nigeria

Obtaining a Tax Identification Number (TIN) is essential for individuals and businesses in Nigeria to comply with tax regulations and facilitate various financial transactions. This guide provides a step-by-step process to help you obtain your TIN efficiently. For seamless online service payments, visit Wigmore Trading.

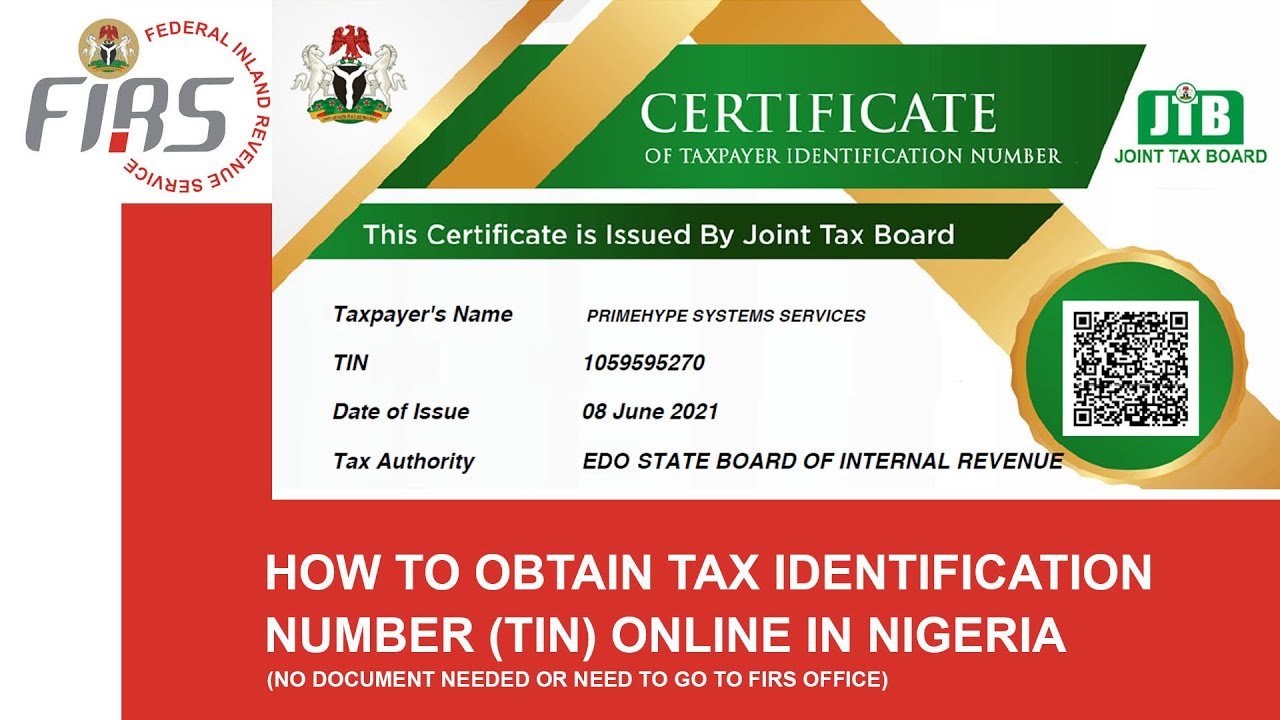

What is a Tax Identification Number (TIN)?

A Tax Identification Number (TIN) is a unique identifier assigned to individuals and businesses for tax purposes by the Federal Inland Revenue Service (FIRS) in Nigeria. It is required for all tax-related activities, including filing tax returns, paying taxes, and conducting business transactions.

Steps to Obtain a TIN in Nigeria

1. Determine Your Category

Overview: The process to obtain a TIN differs slightly for individuals and businesses. Determine your category before proceeding.

- Individuals: This includes employees, self-employed persons, and sole proprietors.

- Businesses: This includes registered companies, partnerships, and incorporated trustees.

2. Gather Required Documents

Overview: Prepare the necessary documents based on your category.

For Individuals:

- Valid Identification: National ID card, Voter’s card, International Passport, or Driver’s License.

- Utility Bill: As proof of address.

- Birth Certificate: Or declaration of age.

For Businesses:

- Certificate of Incorporation: Issued by the Corporate Affairs Commission (CAC).

- Form CAC 1.1: Or Form 2 and Form 7.

- Company’s Memorandum and Articles of Association.

- Utility Bill: As proof of business address.

3. Visit the Federal Inland Revenue Service (FIRS) Office

Overview: Visit the nearest FIRS office to submit your application and documents.

Steps:

- Locate an FIRS Office: Find the nearest FIRS office through the FIRS website or directory.

- Fill Out the Application Form: Obtain and complete the TIN application form at the FIRS office.

- Submit Documents: Submit the completed form along with the required documents.

4. Online Application (For Businesses)

Overview: Businesses can also apply for a TIN online through the Joint Tax Board (JTB) platform.

Steps:

- Visit the JTB TIN Registration Portal: JTB TIN Registration

- Complete the Online Form: Fill out the required details and upload necessary documents.

- Submit Your Application: Follow the instructions to submit your application online.

5. Verification and Issuance

Overview: After submitting your application, FIRS will verify the provided information.

Steps:

- Verification: FIRS will verify your documents and application.

- Issuance: Upon successful verification, you will be issued a TIN certificate.

6. Retrieve Your TIN

Overview: Once issued, you can retrieve your TIN from the FIRS office or via the JTB online portal.

For Online Applications:

- Check Your Email: You will receive an email notification with your TIN.

- Log into the JTB Portal: Retrieve your TIN directly from the portal.

Benefits of Having a TIN

- Compliance: Ensures compliance with Nigerian tax laws.

- Business Transactions: Required for opening business bank accounts and bidding for government contracts.

- Tax Returns: Facilitates the filing of tax returns and payments.

- Legal Recognition: Establishes your business as a legal entity.

Conclusion

Obtaining a Tax Identification Number (TIN) in Nigeria is a straightforward process that requires careful preparation of documents and adherence to the application steps. By following this guide, you can secure your TIN efficiently. For more information and assistance with online service payments, visit Wigmore Trading.

LEAVE A COMMENT

You must be logged in to post a comment.