How to Get Your BVN Number on Your Phone: A Quick Guide for Nigerians

The Bank Verification Number (BVN) is an essential identifier in Nigeria’s banking system, ensuring security and smooth financial operations. Whether you’ve forgotten your BVN or need quick access to it, retrieving it on your mobile phone is straightforward. This guide explains how to check your BVN using your phone and answers common questions about the process.

What Is a BVN?

The BVN is an 11-digit number issued by the Central Bank of Nigeria (CBN) to uniquely identify bank customers. It links all your bank accounts, offering enhanced security and reducing fraud risks. You’ll need it for activities like opening a new bank account, applying for loans, or conducting certain transactions.

How to Retrieve Your BVN on Your Phone

Follow these simple steps to get your BVN instantly:

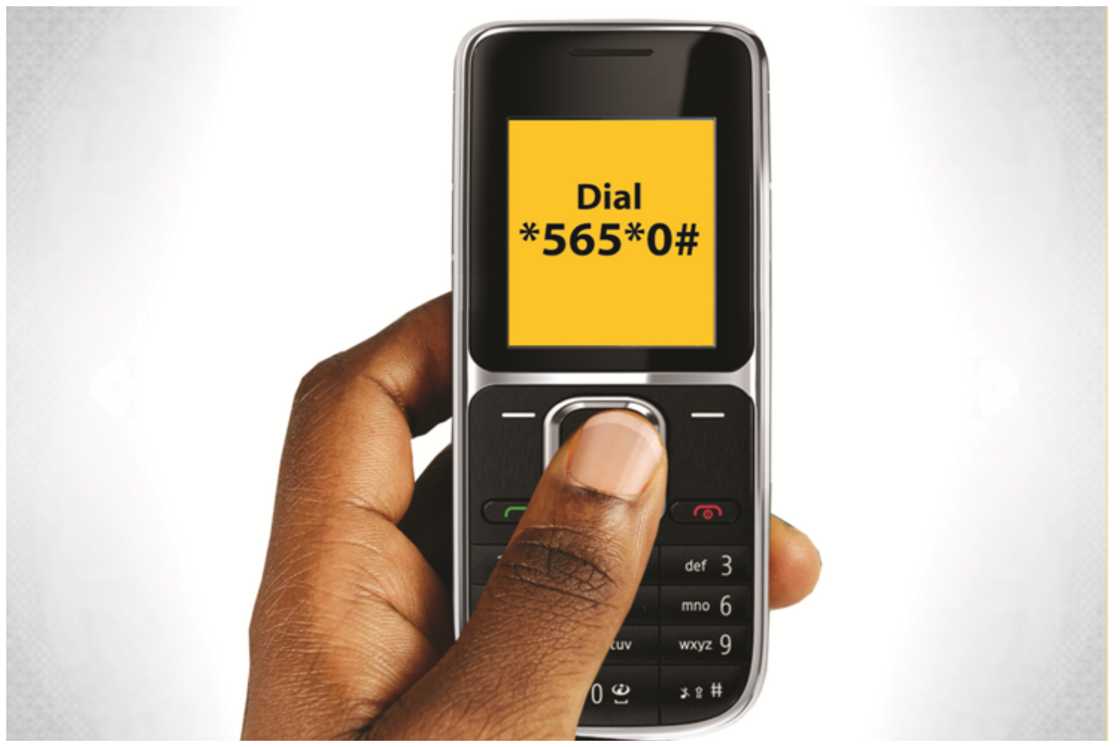

- Dial the BVN Retrieval Code:

- From the phone number you used during BVN registration, dial

*565*0#.

- From the phone number you used during BVN registration, dial

- Follow the Prompt:

- Wait for your BVN to appear on the screen. It’s a straightforward, user-friendly process.

- Cost of the Service:

- A small fee of around ₦20–₦30 is deducted from your airtime, depending on your network provider.

Important Requirements

To retrieve your BVN successfully, ensure:

- You use the phone number linked to your BVN registration.

- Your airtime balance is sufficient to cover the service charge.

Supported Mobile Networks

This retrieval method works across all major telecom networks in Nigeria:

- MTN

- Airtel

- Glo

- 9mobile

Why Can’t I Retrieve My BVN?

If you encounter issues while retrieving your BVN, consider the following solutions:

- Incorrect Phone Number: Ensure you’re dialing from the number linked to your BVN registration.

- Insufficient Airtime: Top up your phone and try again.

- Network Issues: If the problem persists, try again later or contact your network provider.

- Bank Assistance: Visit your bank for support if the issue remains unresolved.

Protecting Your BVN

Your BVN is sensitive information that should be kept secure. Avoid sharing it with unverified parties to protect yourself from fraud. Use it only when required for official banking transactions.

Why Your BVN Matters

The BVN is vital for:

- Bank Account Verification: It links multiple accounts under one identifier.

- Secure Transactions: It helps reduce fraud and unauthorized access.

- Loan Applications: Most financial institutions require your BVN for credit approval.

Wigmore Trading: Your Trusted Partner in Financial Success

At Wigmore Trading, we understand the importance of financial literacy and security. Whether you’re handling local transactions or seeking international trade opportunities, we’re here to guide you. Contact us for expert advice and reliable services tailored to your needs.

Comments are closed.