Importing Goods from Israel to Nigeria: The Complete Guide.

Importing Goods from Israel to Nigeria: The Complete Guide.

Importing goods from Israel to Nigeria is no simple task. It requires careful planning and consideration of all the risks associated with importing goods. For example, there are import duty rates, which govern how much you will have to pay in customs duty on the items you are importing. There are also other fees, such as storage costs and transportation costs, which must be considered. These can pile up quickly if you aren’t careful! Here are some tips for importing products that have worked well for others in the past.

Importing Goods to Nigeria

It’s never been easier to import your products from Israel to Nigeria. Here are a few tips for importing products from Israel to Nigeria that you may want to consider:

1. Always check with your local government agency about import duty rates.

2. Check any fees and taxes on imports so you can budget accordingly.

3. Find out if there are any special requirements for importing goods from Israel to Nigeria.

4. Consider the costs associated with storage and transportation of imported goods from Israel to Nigeria, as well as the cost of the product itself, before deciding whether or not it will be profitable for you as an importer of goods from Israel to Nigeria.

Storing Your Products in Nigeria

If you have a business that imports goods from Israel, it’s important to consider where you’re going to store those goods before they reach buyers. This can be a costly mistake.

Storage costs vary from country to country, so it’s best to do some research on how much storage will cost in your area. You should also take into account any other charges, such as the fee for forwarding the shipment from the freight station to the warehouse and insurance charges. These can add up quickly if you don’t plan ahead!

The first step is finding out how much storage will cost and what else comes with that cost. The next step is considering whether storing your products in Nigeria would be a viable option or not. For example, if there’s no warehouse near you that has the space and rates for what you need then it may make more sense for your company to store your products elsewhere.

What You Need to Know about Taxes

When importing goods to Nigeria, it’s important to know that you are responsible for paying any taxes that are applicable on the import. The Nigerian Customs Service will collect these taxes, so there is usually no need to worry about them. But once you start calculating how much you will have to pay in customs duty on the items you are importing, it’s helpful to have a rough idea of what’s owed.

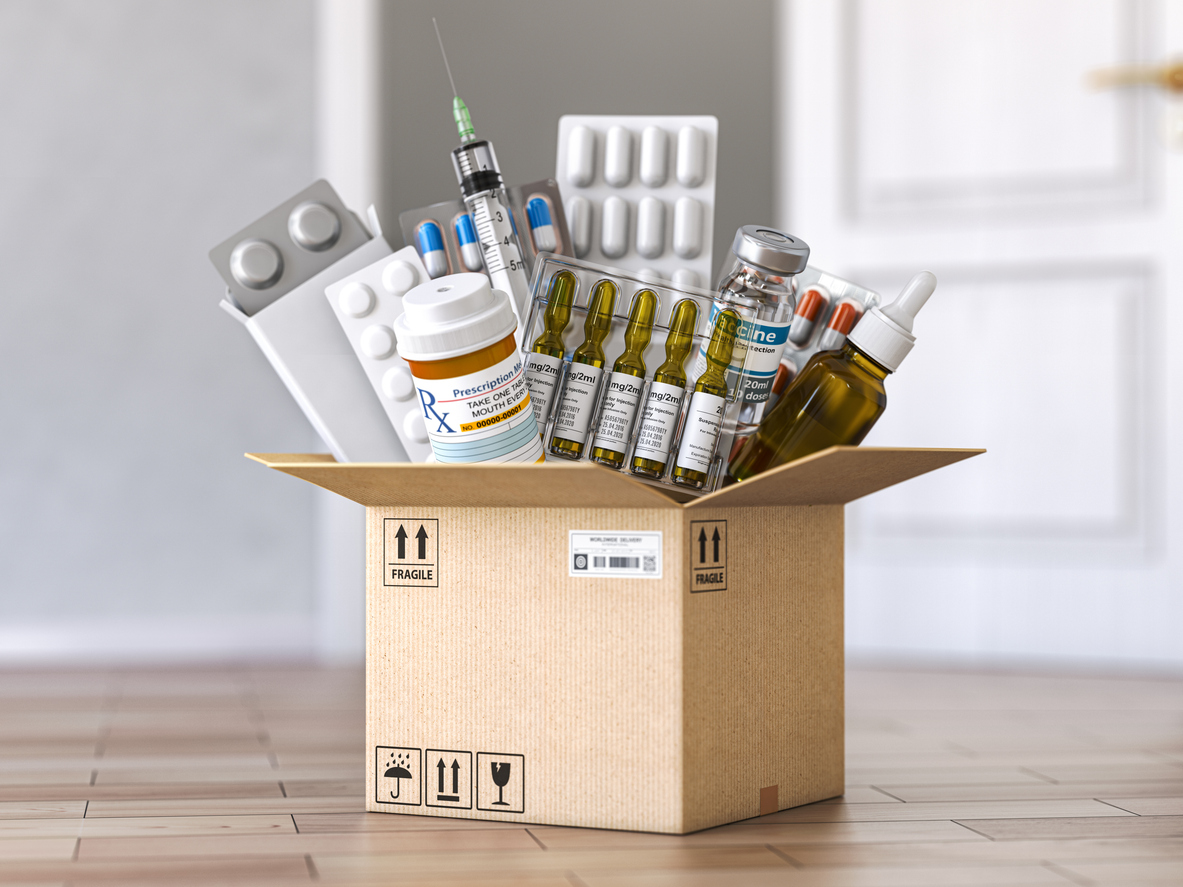

Shipping Your Products

Shipping is one of the biggest risks, but it doesn’t have to be. There are several ways you can reduce your shipping costs.

One way is to find a freight forwarder. Freight forwarders specialize in moving goods from one country to another, so they have all of the right contacts and customers for this. They also have knowledge about international regulations and the paperwork involved with the process. They will also do all of the detailed planning for you, so you can focus on other areas of your business.

Another way to reduce shipping costs is by finding a product that has a low value per kilo or pound. Heavier products generally cost more when it comes to shipping because they require more time consuming packing methods, which are costly. Think about what kind of products would work best for your export business and find ones that are light in weight or small in size!

Conclusion

If you are importing goods from Israel to Nigeria, here are four tips to help you reduce the stress of the process.

1. Make sure to store your products in Nigeria.

2. Review the Nigerian tax code for imported goods.

3. Know the import duties in Nigeria for specific items.

4. Ship your products in compliance with Nigerian customs regulations.

LEAVE A COMMENT

You must be logged in to post a comment.