Oil and Gas Entry Strategy in Nigeria: How to Succeed in Africa’s Largest Energy Market

Nigeria remains Africa’s leading oil producer and a global gas powerhouse, making it an attractive — yet complex — destination for upstream, midstream, and downstream investors. Whether you’re an equipment supplier, technical service provider, or E&P operator, developing a sound oil and gas entry strategy for Nigeria is essential for navigating the regulatory, commercial, and operational landscape.

At Wigmore Trading, we help companies assess market opportunities, meet local compliance requirements, and connect with vetted partners to ensure successful market entry into Nigeria’s dynamic energy sector.

⚙️ Why Enter the Nigerian Oil & Gas Market?

Nigeria offers a compelling mix of:

-

🌍 Proven reserves: Over 36 billion barrels of oil and 200+ trillion cubic feet of natural gas

-

📈 Ongoing investments: Major projects like NLNG Train 7, the AKK pipeline, and marginal field licensing

-

🛢️ Diverse opportunities across upstream (exploration), midstream (transportation), and downstream (refining, marketing)

-

🔄 Energy transition: Government focus on gas monetisation and cleaner fuels (Decade of Gas Initiative)

-

🤝 Public-private partnerships and joint ventures open to foreign participation

📊 Key Considerations for Your Entry Strategy

Entering Nigeria’s oil and gas market requires more than capital — it demands insight, agility, and compliance. Your entry strategy should address the following:

1. Regulatory Framework & Approvals

Understanding Nigeria’s regulatory ecosystem is critical:

-

Petroleum Industry Act (PIA 2021) – Modernized framework for licensing, royalties, and host community engagement

-

Nigerian Content Development Act – Requires minimum local participation in projects and services

-

NNPCL – The restructured national oil company plays a strategic role in partnerships and licensing

Wigmore Trading helps new entrants understand required approvals, permits, and agency expectations, including:

-

DPR/NUPRC licensing

-

NCDMB registration

-

SON, NAFDAC (for equipment and chemicals)

-

NEITI compliance for transparency

2. Local Content & Partnering

The Nigerian Content Development and Monitoring Board (NCDMB) enforces strict local content laws, which affect:

-

Staffing

-

Procurement of goods and services

-

Equipment sourcing

-

Technology transfer

To succeed, foreign firms must develop a clear local content strategy, including:

-

✅ Establishing a local entity or JV

-

✅ Sourcing materials and manpower locally

-

✅ Investing in training and infrastructure

Wigmore Trading facilitates introductions to vetted Nigerian partners and can assist with sourcing NCDMB-compliant materials and services.

3. Supply Chain & Logistics Planning

Nigeria’s infrastructure, while improving, presents logistical challenges. Effective entry requires:

-

⚓ Knowledge of ports (e.g., Lagos, Warri, Onne)

-

🚚 Reliable inland transportation planning

-

📦 Customs clearance expertise

-

🏗️ Access to bonded warehouses and oil service hubs

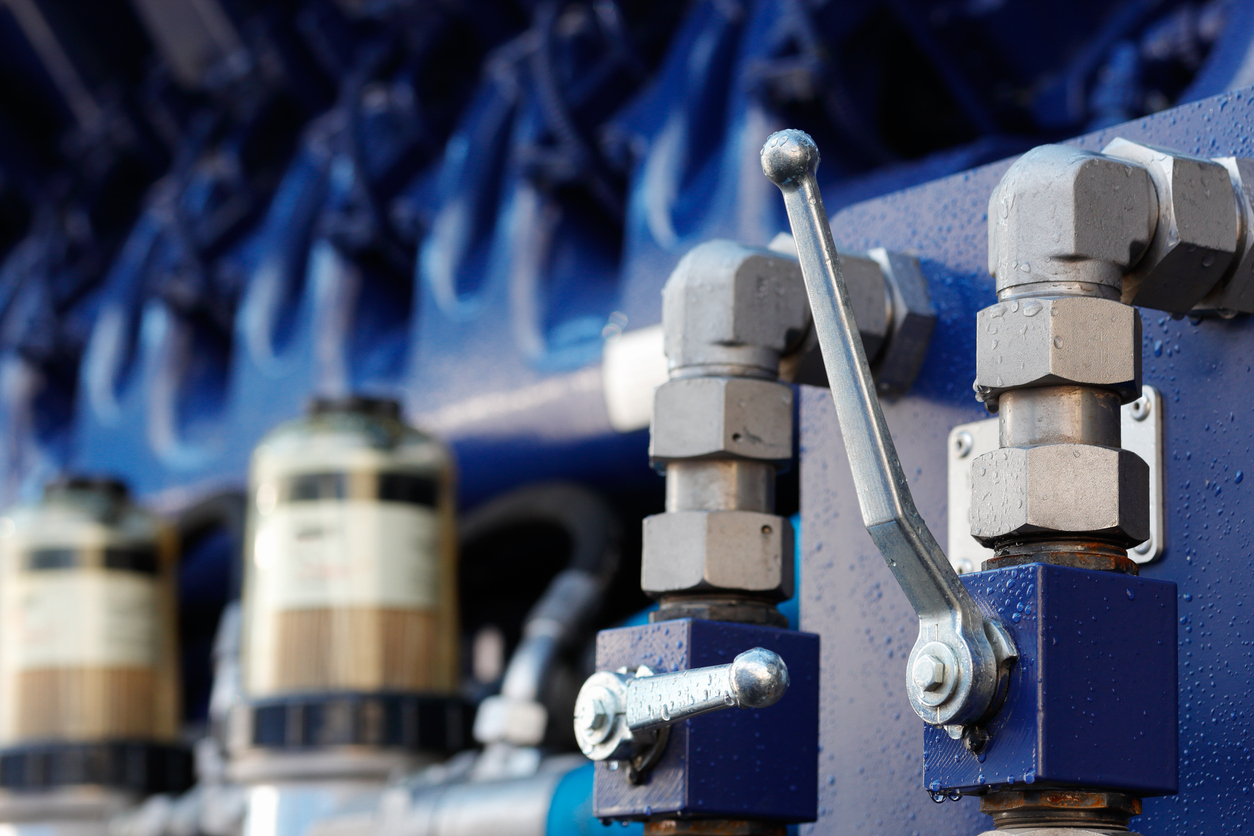

We assist clients with import/export logistics, customs advisory, and vendor identification for everything from pipelines and valves to PPE and instrumentation.

4. Market Positioning & Opportunity Mapping

Your entry plan should include:

-

🎯 Sector focus (upstream, gas monetisation, EPC, FPSO support, etc.)

-

🧭 Competitive landscape analysis

-

🛠️ Tender pipeline tracking (e.g., NNPCL, IOC tenders)

-

📉 Pricing and procurement dynamics

We help you map the opportunity landscape and understand where your products or services fit within Nigeria’s energy value chain.

5. Risk & Compliance Management

Nigeria’s oil and gas sector involves unique risks:

-

🔍 Political and regulatory shifts

-

💱 FX volatility

-

🧑⚖️ Contract enforcement challenges

-

🏘️ Host community relations

Wigmore Trading connects clients with reliable legal, financial, and compliance advisors to structure deals, ensure regulatory alignment, and mitigate operational risk.

🚀 Entry Pathways for Oil and Gas Companies

Choose the right approach based on your size and scope:

| Entry Model | Ideal For | Notes |

|---|---|---|

| Direct Investment | Operators and large EPC firms | Requires full licensing, high capex |

| Joint Ventures (JV) | Tech and service companies | Mandatory for many high-value contracts |

| Local Representation | OEMs and equipment suppliers | Ideal for phased entry and market testing |

| Project-based Contracts | Freelancers, SMEs, international subs | Bids must meet local content conditions |

🌐 How Wigmore Trading Supports Oil & Gas Market Entry in Nigeria

We assist international and Nigerian companies with:

✅ Partner identification & JV facilitation

✅ Supply chain support for project procurement

✅ Regulatory guidance and licensing documentation

✅ Local content compliance consulting

✅ Logistics and customs coordination

✅ Pre-tender intelligence and opportunity alerts

Whether you’re bidding for an EPC contract, supplying process control equipment, or entering Nigeria’s gas services market, Wigmore Trading provides the on-the-ground insight you need to execute confidently.

Ready to Enter Nigeria’s Oil and Gas Sector?

If you’re planning your oil and gas entry strategy in Nigeria, get the right support from the start. Wigmore Trading offers practical, localized expertise to help you operate compliantly, efficiently, and competitively.

📧 Contact us today to explore a custom entry plan or connect with vetted Nigerian partners and service providers.

Comments are closed.