The Definitive Guide to Buying and Exporting Niobium, Tantalum, Vanadium and Zirconium Ore from Rwanda

The Definitive Guide to Buying and Exporting Niobium, Tantalum, Vanadium and Zirconium Ore from Rwanda

Rwanda is home to some of the most valuable ore deposits in the world, including niobium, tantalum, vanadium, and zirconium. For those interested in buying and exporting these precious metals, understanding the complexities of the Rwandan mining industry is essential. This definitive guide provides a comprehensive overview of the processes and regulations involved in buying and exporting ore from Rwanda. We will explore the Rwandan mining industry, the requirements for doing business, the potential risks and rewards of investing in Rwandan ore, and the steps you need to take to ensure a successful business transaction. With this guide, you will be able to confidently navigate the Rwandan ore market and make the most of your investments.

Overview of the Rwandan Mining Industry

Rwanda is home to some of the most valuable ore deposits in the world, including niobium, tantalum, vanadium, and zirconium. Mining, particularly the extraction of these four minerals, has long been the backbone of Rwanda’s economy. More than 80% of Rwanda’s revenue comes from mining, and the industry employs about 50% of the country’s population. The country has been extensively explored for minerals since the 1950s, particularly during the 1970s, when significant discoveries of niobium, tantalum, and vanadium were made. Since then, the government has made a concerted effort to regulate and develop the industry. This effort has greatly expanded Rwanda’s mineral production, and the mineral sector now plays a central role in the Rwandan economy. The country’s mineral regulatory framework has also been strengthened, and numerous laws and policies have been passed to ensure the safety and sustainability of the industry. These include the Mineral Investment Code and the Extractive Industries Transparency Initiative. In fact, Rwanda was the first country in Africa to enact the EITI, and it has been committed to the highest standard of transparency ever since.

Requirements for Doing Business in Rwanda

While the Rwandan government is open to investment, there are specific regulations that investors must comply with. These regulations are in place to protect Rwandan citizens and ensure that all business transactions are conducted ethically, fairly, and transparently. Before you begin any business transactions in Rwanda, you will need to determine which type of investor you are. There are three types of investors in the country: (1) domestic investors, (2) regional investors, and (3) preferential investors. You will need to determine which type of investor you are, as this will affect the types of investments you can make and the associated regulations. Once you have determined your investor type, you will have to apply for the relevant licenses and permits, as well as abide by the associated restrictions. These regulations are designed to protect Rwandan citizens and ensure a fair and transparent business environment.

Potential Rewards and Risks of Investing in Rwandan Ore

Rwanda’s mineral sector is thriving thanks to its abundant resources, skilled workforce, and supportive government. In fact, the government has made significant efforts to support and grow the industry, including lowering taxes on mining companies and improving communication between the government and mining companies. Rwanda has also made significant strides towards improving the country’s infrastructure, including its transportation and communication networks. These improvements are expected to make importing and exporting goods easier and more efficient. These factors combined put Rwanda in a unique position among African countries. Its mineral sector is not only profitable—it has the potential to be a cornerstone of the economy. The Rwandan ore market is one that is expected to thrive in the coming years, and investing in it now offers incredible potential for high rewards. However, there are risks associated with investing in any market, including Rwanda’s. Any investment comes with risk, and the mineral sector is no exception. Before you begin investing in Rwandan minerals, it is important to understand the potential risks involved.

Steps to Ensure a Successful Business Transaction

If you are looking to buy and export mineral ore from Rwanda, it is crucial to understand the entire process from start to finish. This will help you identify potential challenges and find ways to avoid or overcome them as early as possible. The first step is to determine which minerals you want to buy and export. Niobium, tantalum, vanadium, and zirconium are highly valuable minerals that are in high demand across the world. Rwanda is the world’s largest source of niobium and vanadium ore, second-largest source of tantalum ore, and third-largest source of zirconium ore. Once you’ve chosen your minerals, you will need to find miners or mining companies that sell ore. This can be done through mining magazines, mining websites, and mining exhibitions. Once you’ve found a mining company, you will need to negotiate an agreement. This agreement should include the pricing and quantities of ore being sold, the method of payment, and the terms and conditions of the transaction.

Regulations and Licenses Needed to Buy and Export Ore

All mineral transactions in Rwanda are subject to the Mineral Investment Code. This code was designed to ensure that all mineral transactions are conducted in an ethical and transparent manner. To ensure compliance with the code, the Rwandan government has created a Mineral Trading Confidentiality Agreement as well as a Mineral Trading Confidentiality Policy. When negotiating a mineral transaction with a Rwandan company, you will need to provide proof of your company’s source of funds. This can be done through a letter of credit (LC) or official confirmation of funds transfer (OFCT). In addition, non-Rwandan entities must also have an authorized agent in Rwanda. This agent will provide administrative and legal assistance, as well as ensure that all relevant regulations are followed.

Types of Ore Available in Rwanda

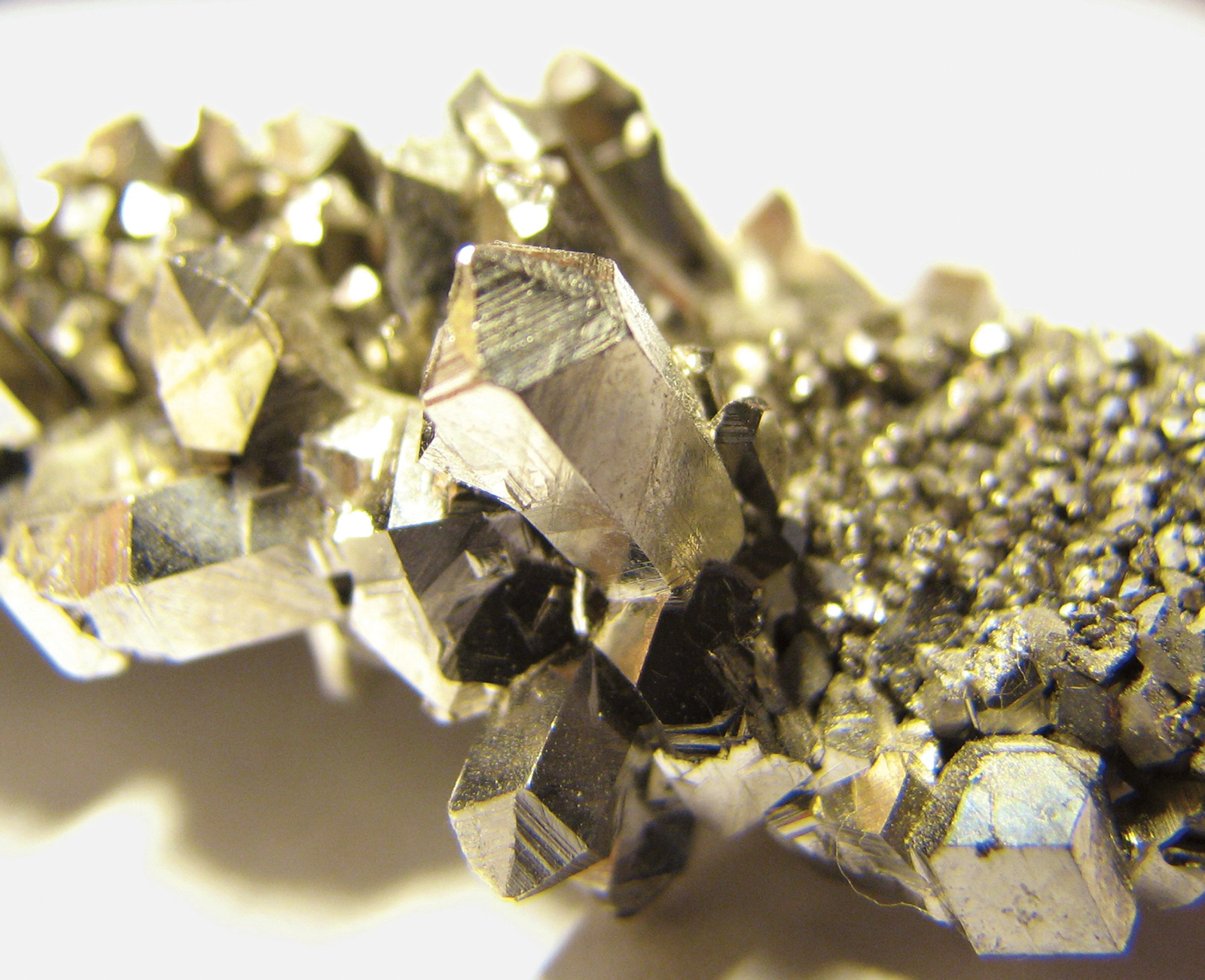

Rwanda is home to some of the most valuable and rare minerals in the world, including niobium, tantalum, vanadium, and zirconium. These minerals occur naturally in rocks and sandstones, and they can be extracted through mining. Niobium and tantalum are both rare transition metals. They are primarily used in the production of high-tech materials, such as carbide, superalloys, and ferroalloys. Vanadium is a soft, silvery-gray metal used in alloys and in industrial applications. Zirconium is a hard, silvery-white metal used in alloys, as well as in aerospace and automotive applications. Each of these minerals can be purchased and exported from Rwanda.

Pricing and Delivery of Mineral Ore

When negotiating a mineral transaction with a mining company in Rwanda, you will need to establish a mutually beneficial price. Mineral prices are determined by several factors, including the quality of the ore and the quantity available for sale. The price of each mineral will vary depending on these factors, and there is no standard pricing system across the industry. However, mining companies will often try to sell minerals at a high price. Before you begin negotiations, it is important to understand what each mineral is worth and how the pricing process works. This will help you avoid being exploited and negotiate a fair price. Mineral ore is often delivered to their purchasers by the mining company’s subsidiary or agents. This delivery can be by ground, rail, or sea. The method of delivery will depend on the quantity of ore being purchased and the distance between the mining company and the purchaser.

Potential Challenges When Buying and Exporting Ore from Rwanda

Any business transaction in Rwanda comes with inherent risks. Before entering into a mineral transaction, it is important to be aware of the potential challenges and how to overcome them or minimize their impact. One of the most common challenges is dealing with a dishonest or fraudulent mining company. It is important to exercise due diligence when searching for a mining company and negotiating a mineral transaction. This will help you avoid dishonest or fraudulent companies and ensure a successful business transaction. Another potential challenge when buying and exporting mineral ore from Rwanda is logistics. Mineral ore is often delivered to their purchasers by the mining company’s subsidiary or agents. This delivery can be by ground, rail, or sea. The method of delivery will depend on the quantity of ore being purchased and the distance between the mining company and the purchaser.

Resources for Further Research and Information

To learn more about the Rwandan mining industry, visit the Mining Journal, Mining Intelligence, and Metal Bulletin websites. These websites offer insightful commentary, analysis, and news on the industry. You can also read the Annual Report of the Ministry of Miner

LEAVE A COMMENT

You must be logged in to post a comment.