Unlocking the World of Gold Trading: How Wigmore Trading Facilitates the Global Supply of Gold Bars and Dust

Unlocking the World of Gold Trading: How Wigmore Trading Facilitates the Global Supply of Gold Bars and Dust

Welcome to the glittering world of gold trading! Have you ever wondered how this precious metal, coveted for centuries, finds its way from mines to your jewelry box or investment portfolio? Look no further than Wigmore Trading, the mastermind behind facilitating the global supply of gold bars and dust. Join us on an exhilarating journey as we unlock the secrets of this fascinating industry and discover how Wigmore Trading is revolutionizing gold trading worldwide. Get ready to delve into a world shimmering with opportunity and uncover the hidden treasures that make gold one of the most sought-after commodities on the planet.

Introduction to Gold Trading and Wigmore Trading

Introduction to Gold Trading

Gold has been a highly valuable and sought-after commodity for centuries, with its allure dating back to ancient civilizations. Its rarity, durability, and malleability have made it a symbol of wealth and power throughout history. In today’s modern world, gold continues to hold significant value as an essential element in various industries such as jewelry making, electronics, and finance.

However, the process of acquiring and trading gold can be complex and challenging due to its diverse sources and global demand. This is where Wigmore Trading enters the picture – a leading name in the world of gold trading that has been facilitating the supply of superior quality gold bars and dust across borders for over three decades.

In this section, we will dive into the basics of gold trading and how Wigmore Trading plays a crucial role in making this precious metal available globally.

Understanding Gold Trading

Gold trading is essentially buying or selling physical or paper forms of gold with the aim of profiting from price fluctuations. It involves purchasing at a lower price point and selling when prices increase or vice versa for short-term gains. However, some investors also view investing in gold as a long-term strategy for diversifying their portfolio.

The two main types of gold trading are physical (buying actual physical gold) or paper (investing in financial products backed by physical gold).

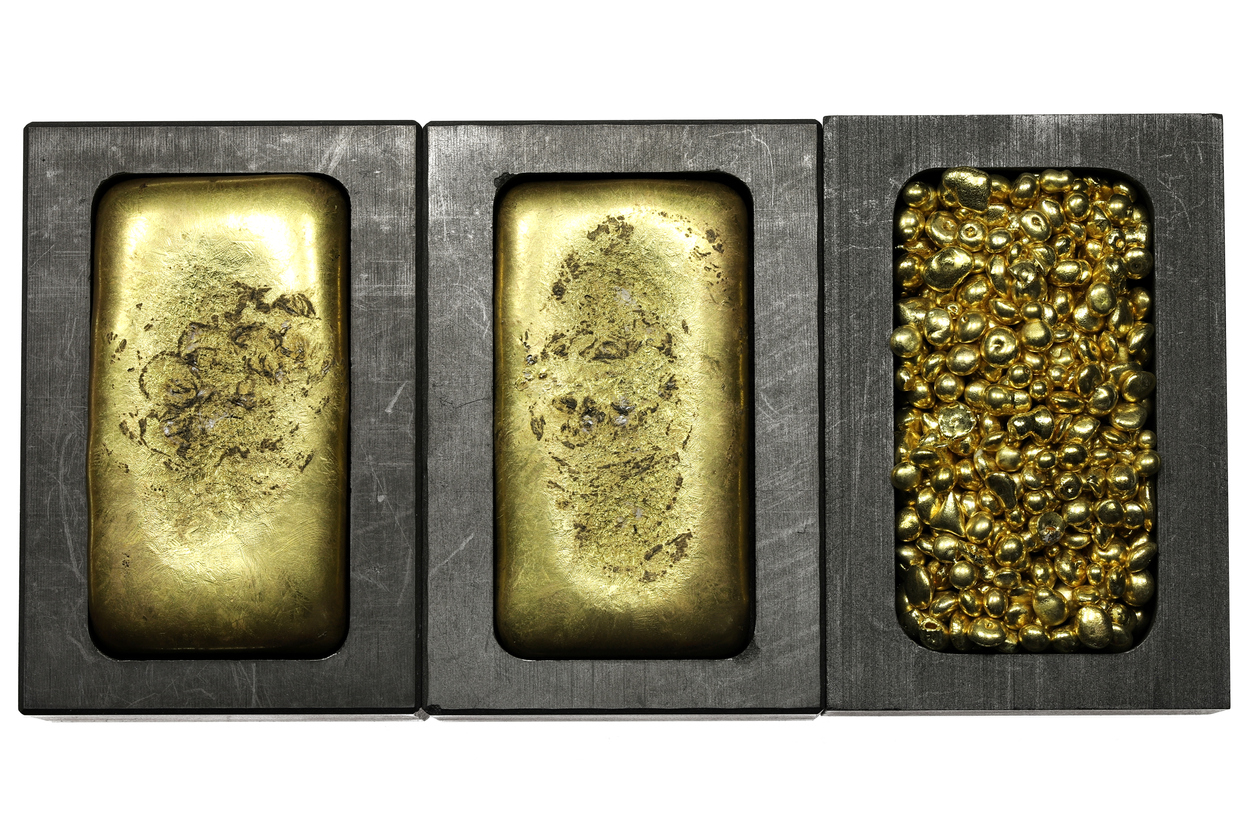

What is Gold Dust and Gold Bars?

Gold dust and gold bars are two forms of gold that are commonly traded in the global market. While they may seem similar at first glance, there are some important differences between these two forms of gold. In this section, we will delve deeper into what exactly gold dust and gold bars are.

What is Gold Dust?

Gold dust refers to tiny particles of pure gold that have been separated from its natural form, such as flakes or nuggets. These particles can be found in rivers, streams, or even mined from underground deposits. They are created through erosion and weathering processes over time.

Due to their small size and weight, gold dust is often collected using specialized equipment such as sluices or dredges. It can also be extracted by panning – a method where the mixture of water and sediment is swirled around in a pan until the heavier particles (including the gold) settle at the bottom.

Gold dust is not considered a practical form for large-scale trading due to its low purity levels and irregular shapes. Therefore, it often needs to be refined before it can be used for commercial purposes.

What is Gold Bars?

On the other hand, gold bars refer to larger amounts of pure gold that have been melted down and cast into specific weights and sizes for easier handling and storage. These bars typically range from 1 gram to 400 ounces (12.4 kilograms) in weight.

The Global Demand for Gold

The demand for gold has been steadily increasing over the years, with the global market for gold estimated to be worth $250 billion. Gold is a highly sought-after precious metal, known for its unique properties such as durability, malleability, and scarcity. It has been used as a form of currency and a store of value for centuries, making it an integral part of many cultures and economies.

One of the primary drivers of the global demand for gold is its use in jewelry production. According to the World Gold Council, over 50% of all gold mined is used in the creation of jewelry. In countries like India and China, gold holds cultural significance and is often given as gifts during special occasions such as weddings or festivals. This steady demand from these two countries alone accounts for approximately 50% of the total annual global demand.

Aside from its traditional use in jewelry-making, there are also various industrial applications that require gold. These include electronics such as smartphones and computers, where it is used in circuit boards due to its excellent conductivity properties. The medical industry also uses small amounts of gold in diagnostic equipment and treatments due to its biocompatibility.

Furthermore, central banks around the world hold significant amounts of physical gold reserves as part of their foreign exchange reserves. This practice dates back to ancient times when central banks would store their wealth in physical forms such as gold coins or bars. Today, many central banks still hold onto this tradition by maintaining a portion of their reserves in physical gold.

How Wigmore Trading Facilitates the Global Supply of Gold

Wigmore Trading is a leading player in the global gold trading market, facilitating the supply of gold bars and dust to various destinations across the world. The company has established itself as a trusted partner for both suppliers and buyers, providing efficient and reliable services that enable smooth trade of this coveted precious metal.

One of the key ways Wigmore Trading facilitates the global supply of gold is through its extensive network of suppliers and buyers. With years of experience in the industry, the company has built strong relationships with top producers and refineries in major gold-producing countries such as South Africa, Australia, Russia, and Canada. This allows them to source high-quality gold bars and dust directly from these sources at competitive prices.

In addition to their well-established supplier network, Wigmore Trading also adopts a rigorous quality control process to ensure that all gold products meet international standards. This involves conducting on-site inspections at mines and refineries, as well as thorough testing by accredited laboratories before shipment. As a result, customers can be assured that they are receiving top-grade gold that is free from impurities or any other fraudulent activities.

Another crucial aspect of how Wigmore Trading facilitates global supply is through their logistics expertise. The company has a team of experienced professionals who manage every aspect of shipping – from paperwork to transportation – ensuring timely delivery to any destination worldwide. They work closely with reputable logistics partners to secure safe transportation methods for valuable cargo like gold bars and dust.

Our Partners: Reputable Gold Sellers

At Wigmore Trading, we understand the importance of having reliable and trustworthy partners in the gold trading industry. That is why we have established strong relationships with reputable gold sellers around the world to ensure a steady supply of high-quality gold bars and dust for our clients.

Our partners are carefully selected based on their track record, reputation, and adherence to ethical business practices. We only work with well-established and respected gold sellers who have a proven history of delivering top-notch products and excellent customer service.

One of our main partners is ABC Gold Company, a leading supplier of certified gold bars in Africa. They have been operating in the industry for over 20 years and have built a strong reputation for their commitment to quality and integrity. ABC Gold Company sources its gold from legitimate mines in Ghana, Tanzania, and Mali, ensuring that all their products meet international standards.

Another key partner is XYZ Mining Corporation, one of the largest mining companies in South America. With decades of experience in the industry, they are known for their state-of-the-art facilities and advanced mining techniques that result in superior quality gold dust. Their strict adherence to responsible mining practices also aligns with our values at Wigmore Trading.

In addition to these major partnerships, we also collaborate with several other trusted suppliers from different parts of the world such as Europe, Asia, Australia, and North America. This diverse network allows us to offer a wide range of options to our clients while maintaining high-quality standards.

The Process of Buying and Selling Gold with Wigmore Trading

At Wigmore Trading, we pride ourselves on being a trusted and reliable facilitator of gold trading on a global scale. Our experienced team is dedicated to providing seamless transactions for both buyers and sellers of gold bars and dust.

The process of buying and selling gold with Wigmore Trading starts with understanding the needs and requirements of our clients. We work closely with both parties to ensure that their goals are met, whether it be purchasing gold as an investment or sourcing high-quality gold for industrial use.

For buyers, our process begins by identifying the specific type and quantity of gold they are looking for. Our vast network allows us to source gold from various countries, ensuring a diverse range of options for our clients. We also provide detailed information about the origin, purity, and certification of the gold to give buyers peace of mind in their purchase.

Once a buyer has selected their desired product, we then facilitate the negotiation process between them and the seller. Our team utilizes advanced technology to ensure secure communication between all parties involved.

For sellers, Wigmore Trading offers a smooth selling experience by first verifying the authenticity of their gold through rigorous testing methods. This includes analysis using state-of-the-art equipment such as X-ray fluorescence (XRF) machines.

Once verified, we assist sellers in finding potential buyers who match their desired price point. With our extensive database and industry knowledge, we can connect sellers with reputable buyers who are interested in purchasing their specific type of gold.

Benefits of Investing in Gold through Wigmore Trading

Investing in gold has long been considered a safe and stable way to diversify one’s investment portfolio. With the unpredictable nature of financial markets, gold has proven to be a reliable asset that retains its value over time. In recent years, there has been a growing trend towards investing in gold through online trading platforms such as Wigmore Trading.

Here are some of the key benefits of choosing Wigmore Trading as your gateway to the world of gold trading:

1. Global reach: One of the major advantages of investing in gold through Wigmore Trading is the global reach it offers. With this platform, investors have access to a wide range of suppliers from various countries around the world. This means that you can choose from a diverse selection of gold bars and dust based on your investment goals and budget.

2. Competitive pricing: Another benefit of investing in gold through Wigmore Trading is competitive pricing. The platform works directly with reputable suppliers, cutting out middlemen and ensuring that customers get access to fair market prices for their investments. This not only maximizes returns but also minimizes the risk associated with price fluctuations.

3. Secure transactions: Security is always a top priority when it comes to any type of investment, especially online trading platforms. At Wigmore Trading, all transactions are conducted through secure channels using advanced encryption technology to protect sensitive information and prevent fraud or cyber attacks.

Risks and Considerations when Trading Gold

Investing in gold has long been considered a safe haven for many traders, especially during times of economic uncertainty. The shiny metal has maintained its value and served as a reliable store of wealth throughout history. However, like any other investment opportunity, trading gold also comes with its own set of risks and considerations that traders should be aware of before entering the market.

In this section, we will discuss some key risks and considerations to keep in mind when trading gold:

1. Price Volatility:

One of the primary risks associated with trading gold is its price volatility. Gold prices are influenced by various factors such as economic conditions, geopolitical events, and supply and demand dynamics. These factors can cause significant fluctuations in the price of gold within a short period, making it a highly volatile asset to trade.

2. Market Liquidity:

Gold is widely considered a liquid asset due to its high demand globally. However, there may be instances where the market liquidity for physical delivery of gold bars or dust may be limited. This could result in delays or difficulties in converting your investment into cash quickly.

3. Storage Costs:

Unlike other financial instruments that exist purely on paper, trading physical gold requires proper storage facilities to keep it protected from theft or damage. Depending on the quantity of gold you are trading, storage costs can add up significantly over time.

4. Counterparty Risk:

When purchasing physical gold from an individual seller or company, there is always a risk that they may default on their obligations or engage in fraudulent activities.

Conclusion and Future Outlook for the Gold Market

Conclusion and Future Outlook for the Gold Market

Wigmore Trading plays a significant role in facilitating the global supply of gold bars and dust. With their extensive network of trusted suppliers and buyers, they are able to provide efficient and secure trading services to their clients.

The current demand for physical gold is on the rise, driven by various factors such as economic uncertainty, geopolitical tensions, and inflation concerns. This has led to an increase in gold prices and has made it a favorable investment option for many investors.

However, the future outlook for the gold market remains uncertain. Some experts predict that with the global economy slowly recovering from the impact of the pandemic, there may be a decrease in demand for safe-haven assets like gold. On the other hand, others believe that ongoing economic uncertainties will continue to drive up demand for gold.

One thing is certain – gold will always remain a valuable asset and a hedge against market instability. Its intrinsic value and limited supply make it a reliable store of wealth even in times of crisis.

With its expertise in the gold market, Wigmore Trading is well-positioned to adapt to any changes or challenges that may arise. The company continuously monitors market trends and leverages its vast network to ensure their clients receive competitive prices for their gold transactions.

As technology continues to advance, we can expect further developments in how gold trading is conducted globally. One trend that has emerged recently is digital platforms offering easy access to buying and selling physical precious metals like gold.

Comments are closed.