How To Export Rolled Tobacco From Nigeria, Customs Procedure

How To Export Rolled Tobacco From Nigeria, Customs Procedure

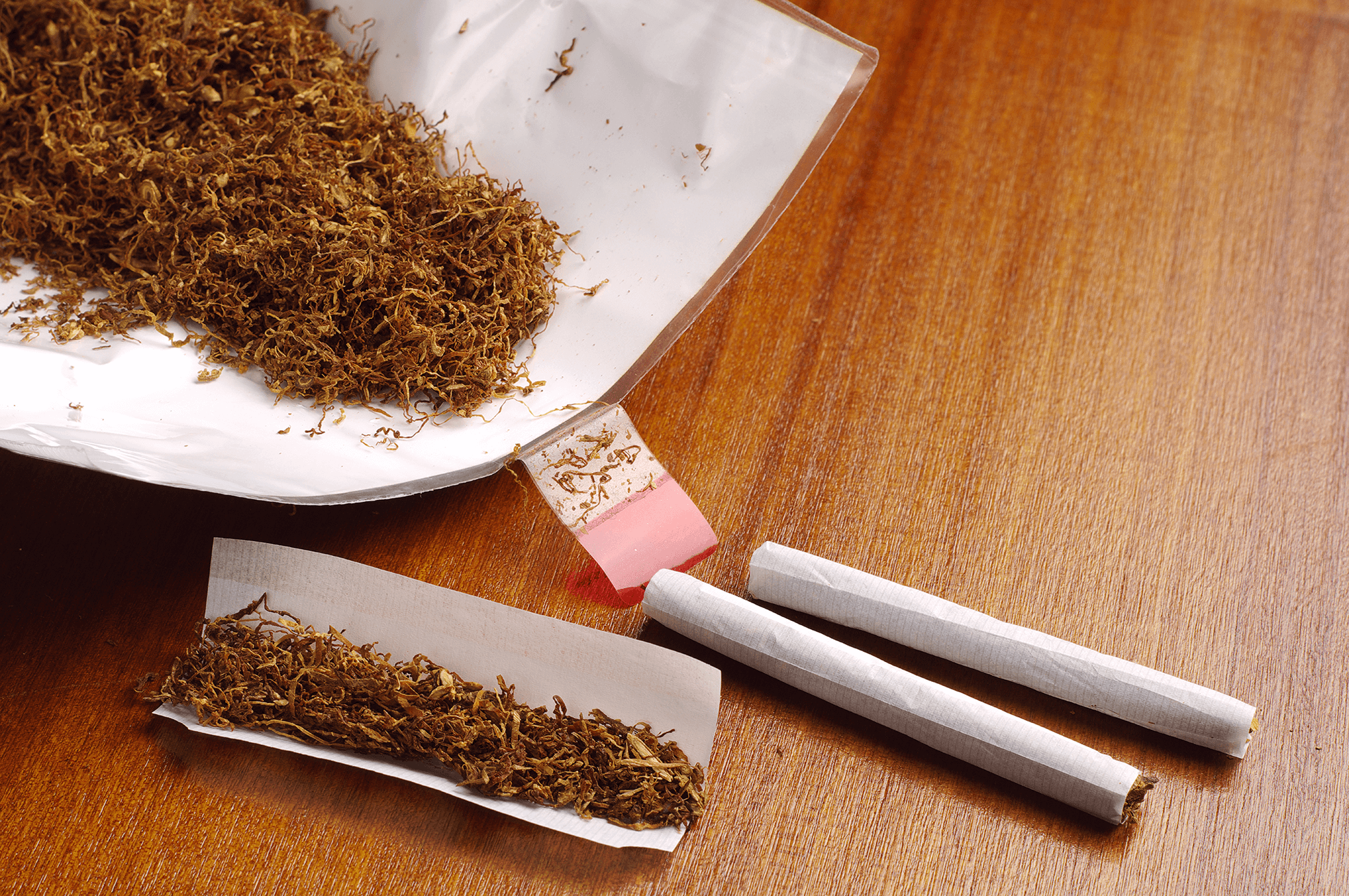

It is quite challenging to import roll-your-own tobacco into Nigeria, as it is classified as a prohibited product. The best option for importing loose leaf tobacco into Nigeria is an airtight container. You can pack your bags in a vacuum sealer or zip lock bag, then place them in the container.

While it’s not necessary, you may also want to include a desiccant packet with your order. This will absorb the moisture inside the container and keep your tobacco fresh during transport. Once you’ve prepared your shipment, set up an account with our customs broker. They’ll provide you with the information needed to make this export clearance process easy and hassle-free!

Importing Rolled Tobacco

Rolled tobacco is prohibited in Nigeria, but you can import it if it is in an airtight container.

Importing rolled tobacco into Nigeria can be difficult. It is classified as a prohibited product. The best option for importing loose leaf tobacco into Nigeria is an airtight container. You can pack your bags in a vacuum sealer or zip lock bag, then place them in the container.

While it’s not necessary, you may also want to include a desiccant packet with your order. This will absorb the moisture inside the container and keep your tobacco fresh during transport. Once you’ve prepared your shipment, set up an account with our customs broker. They’ll provide you with the information needed to make this export clearance process easy and hassle-free!

How to import rolled tobacco

Opened packages of loose, packable tobacco are not permitted in Nigeria. Packaged tobacco products are available, but they are taxed at a higher rate.

Packaged tobacco products, like cigarettes or cigars, are imported into Nigeria by the Nigerian Bureau of Standards (NBS), which charges a tax based on the quantity of tobacco in the package.

It is usually easiest to import opened packages of tobacco products. These are imported by the NBS, which charges a tax based on the quantity of tobacco in the package.

If you are importing loose-packable tobacco, it is possible to do so, but you must pack it in an airtight container. This container must be labeled according to Nigerian customs regulations and include accurate weight and product information.

If you would like to import an opened package of loose-packable tobacco, you will need to obtain an import license for these products.

What is the best type of container for importing tobacco?

For importing loose leaf tobacco from Nigeria, it’s best to pack your shipment in a vacuum sealer or zip lock bag. You can then place this bag into a container.

While it’s not necessary to have a desiccant packet in your shipment, it may help keep the tobacco fresh during transport. If you want to be safe, you can also include a desiccant packet in your shipment.

Once you have all the items you need, you can set up an account with our customs broker. They’ll provide you with the information you need to make this process easy and hassle-free!

Include a desiccant packet with your order

In order to import roll-your-own tobacco into Nigeria, you will need to use a vacuum sealer or zip lock bag. You can also pack your bags in an airtight container and include a desiccant packet to help keep your product fresh.

Roll-your-own tobacco is classified as a prohibited product in Nigeria, so the best option for importing loose leaf tobacco is an airtight container. You can pack your bags in a vacuum sealer or zip lock bag, then place them in the container. You can also use a vacuum sealer or zip lock bag to pack your tobacco.

When you’re preparing your shipment, set up an account with our customs broker. They’ll provide you with the information needed to make this export clearance process easy and hassle-free!

Setting up an account with our customs broker

Setting up a customs broker account is a simple task! You can use an online tools to do it in a few clicks.

We recommend going with a broker that provides a free onboarding process. They’ll also charge a small fee for each order you send them. These fees vary depending on the size and type of the shipment, but they typically range from $75 to $150.

It’s not a difficult process to set up an account with a customs broker. Many brokers offer a free onboarding process, which is why we recommend going with one of them. It’s typically quick and easy, and they’ll provide you with all the information you need to make this process as easy as possible!

LEAVE A COMMENT

You must be logged in to post a comment.