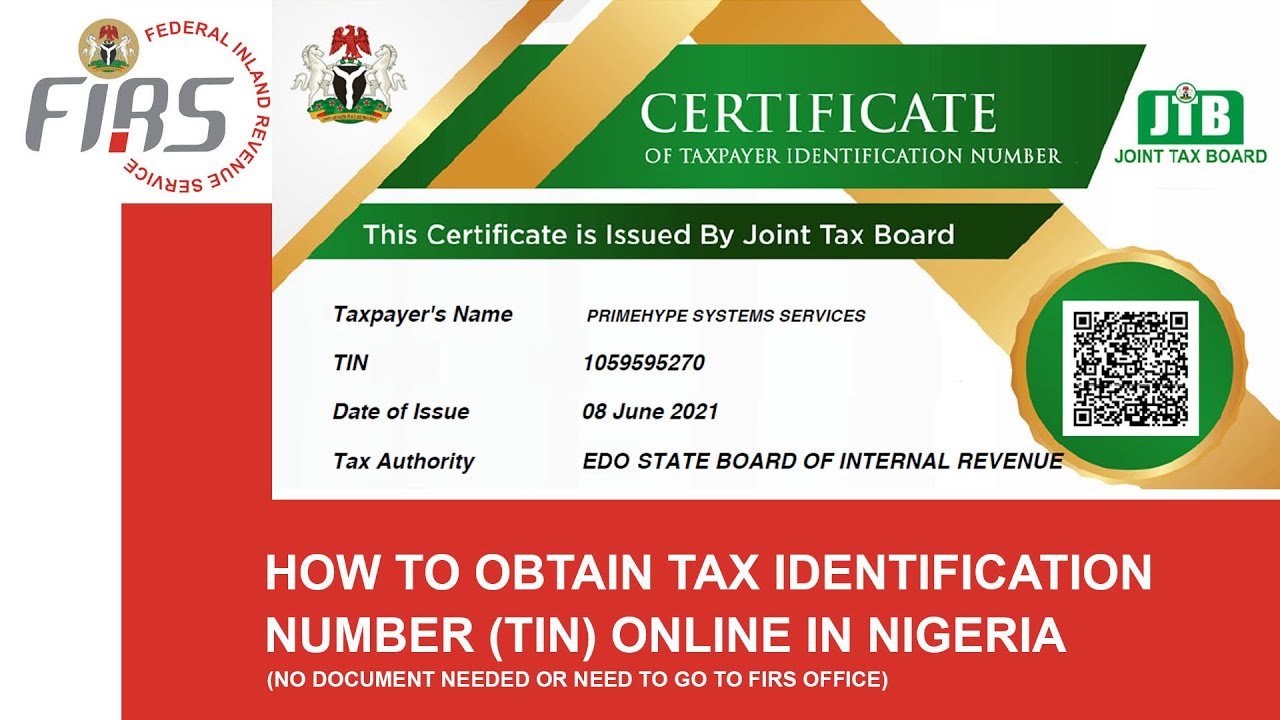

How To Get Tax Identification Number In Nigeria

How To Get Tax Identification Number In Nigeria: An Ultimate Guide

In Nigeria, taxes are an inevitable obligation. Everyone has to pay taxes, and the exact amount that you need to pay as a tax liability will depend on your earnings and other factors such as deductions. So if you’re thinking about working in Nigeria or opening up a business here, then you should know that you need to get a Tax Identification Number (TIN) before you commence any business activities. This means that you also need a Taxpayer ID number to file your taxes correctly and avoid penalties from the Inland Revenue Service . This article will shed light on the importance of a tax identification number in Nigeria, benefits of getting one, how to get one, what documents are required for registration, how to locate your nearest TIN registration centre and more.

What is a Tax Identification Number (TIN) in Nigeria?

A Tax Identification Number (TIN) is a unique number used to identify taxpayers and record their tax liabilities. A TIN is also known as a Taxpayer Identification Number. The TIN was introduced in the United States in 1952. A TIN functions as a unique identifier that is used to report an individual’s income and taxes to the government. The TIN is also used to identify taxpayers when they file their taxes to avoid any errors. The TIN is similar to a Social Security Number in the United States, but unlike the SSN, the TIN is not used for identification purposes.

Why You Should Get A Tax Identification Number

– A TIN is needed for any income-generating activity, whether you’re employed or self-employed. – A TIN is also needed if you want to claim for tax deductions or tax credits. – You also need a TIN to open a bank account or apply for a loan. – You will also need a TIN during business registration and to file your tax returns. – A TIN is necessary to open a business bank account in Nigeria. – If you’re self-employed, you will need a TIN to open a business account and to file your tax returns. – If you’re employed, you will need a TIN to claim deductions on taxes.

Benefits of Getting a TIN in Nigeria

– A Tax Identification Number is needed to open a bank account in Nigeria. – A TIN is also needed if you want to open a business bank account in Nigeria. – Obtaining a TIN is free of charge. – It is valid for 5 years. – Having a TIN is a must if you want to do business in Nigeria. – It makes tax filing and claiming deductions easier. – It is a gateway to other government-related services. – It is also needed if you want to secure a visa or work permit in Nigeria. – A TIN exempts you from paying a lot of taxes as it is used to deduct taxes from your monthly salary.

How to Get a TIN in Nigeria?

Getting a Tax Identification Number in Nigeria is actually pretty easy. You don’t need to go to the tax office to do this, as you can get a TIN online. TINs are issued by the Nigerian Tax Commission. Here is how you can get a TIN. – First, head to the Naij.com website and click on the Get TIN button. – On the next screen, you will see the following instructions: – First, select the state where you will be operating your business. – Next, select the city where you will be operating your business. – Now, select the type of business you will be operating. – Select the type of business account you will be opening. – The next step requires you to provide your personal information including your name, address, and phone number. – You will also be required to enter your email address, password, and security questions. – You will also be asked to select a security question. – The last step requires you to select your preferred language. – Once you’ve completed all of the above steps, you will be directed to a page that will show your Tax Identification Number. – Make sure to save this TIN for future reference. – You can also get this TIN in person by visiting your nearest TIN registration centre.

Documents Required to Register for a TIN

– You will need to have your name written in the Hausa or English language. – Photocopy of your National Identity card. – Photocopy of your passport. – Photocopy of your birth certificate or a letter from your embassy if you are not a Nigerian. – A Utility bill from a recognised company. – A letter from your employer if you are an employee. – A letter from the government if you are self-employed. – A letter from the bank if you want to open a business account. – A business plan if you want to open a business.

Conclusion

A Tax Identification Number should be one of the first things that you should get when you decide to settle in Nigeria. This number is a nine-digit number that will be issued to you by the Nigerian Tax Commission after you’ve registered. A TIN will make tax filing easier as your earnings and tax liability will be recorded with this number. If you’ve been thinking about moving to Nigeria, then you should also be aware of the challenges that come with it. One of them is the fact that you will be expected to pay taxes. Luckily, if you’re employed, your employer will take care of your taxes for you. If you’re self-employed, then you need to obtain a Tax Identification Number. Getting a TIN is easy and can be done online or at any nearby TIN registration centre.

LEAVE A COMMENT

You must be logged in to post a comment.